In their new book, The Execution Challenge: Delivering Great Strategy at Scale, Cutter Experts Brian Cameron and Whynde Keuhn deliver a practical guide for effectively executing strategy in today’s complex and fast-changing environments. This Advisor presents a strategic portfolio management case study from the book that illustrates the value that a capability perspective can bring to project portfolio decision-making.

Strategic Portfolio Management

According to Gartner, organizations that are highly effective at strategic portfolio management are twice as likely to achieve better business outcomes as those that aren’t. The focus on digital business and digital transformation means that the traditional, siloed style of portfolio management is inadequate as siloed portfolios cannot work in isolation to provide the organization with a true picture of strategy execution and overall organizational performance. Integrated strategic portfolio management is needed for effective strategy execution and to optimize the value of all major organizational investments.

Strategic portfolio management forges a critical link between the strategic planning process and the project execution process, enabling management to reach consensus on the best use of resources by focusing on projects strategically aligned with the goals of the organization. It also ensures that projects are aligned with each other and do not produce duplicative or conflicting business outcomes or solutions.

Capability-Based Project Portfolio Management Case Study

The following case study reflects these strategic portfolio management concepts in action.

Situation

This case study is from a Fortune 500 organization and illustrates the value that a capability perspective can bring to project portfolio decision-making. The organization had multiple project portfolios, each structured around a different product or function. One executive leader managed each portfolio and determined the investments for the next horizon. Together, the leaders formed a portfolio leadership committee representing the scope of investments for the enterprise.

The portfolio leaders suspected that there may have been some misalignment of project investments both across the portfolios and back to the strategy. However, they did not have data to substantiate this. As a result, they requested an analysis of the project investment requests through an enterprise capability lens, both within and across the portfolios.

Course of Action

To perform the analysis, the strategic planning and strategic business architecture teams worked together to:

-

Align each project investment request back to the strategy and the specific business objectives that it was enabling.

-

Align each project investment request to one or more capabilities that were intended to be enhanced.

-

Aggregate the level of strategy enablement and planned investment by capability within and across portfolios and visualize as capability heatmaps. (Note: level 2 or 3 capabilities provide the ideal granularity for this type of decision making.)

-

Synthesize the results into a set of key findings and recommendations to present to the portfolio leadership committee.

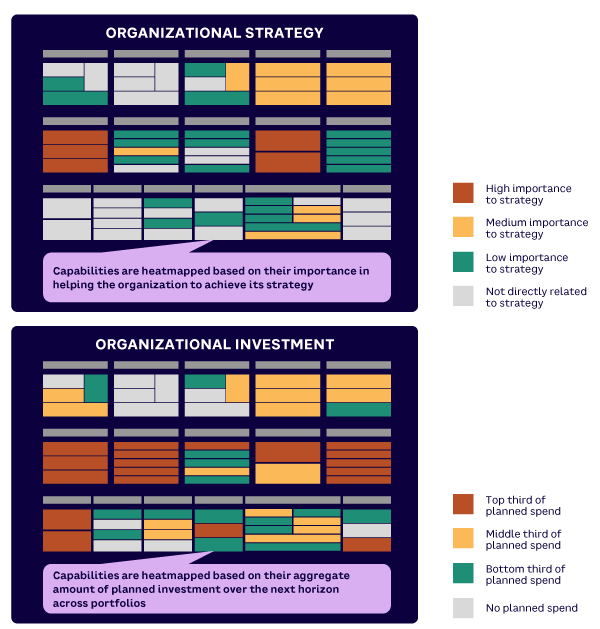

Figure 1 compares two key summary views from the analysis. The organization’s level 2 capability map is shown in both views but aggregates different information. (Note: the capability names have been removed from the boxes for confidentiality.)

The Organizational Strategy view shows the importance of each capability to the organization’s strategy. The color scheme for heatmapping in this view would typically be:

-

Red boxes indicate a capability of high importance to achieving the strategy.

-

Yellow boxes indicate a capability of medium importance to achieving the strategy.

-

Green boxes indicate a capability of low importance to achieving the strategy.

-

Gray boxes indicate a capability that is not directly related to an organization’s ability to achieve its strategy (though of course it would still be important to its successful operation).

On the other hand, the Organizational Investment view shows an aggregation of the planned spend for each capability across all the portfolios. (Individual views for each portfolio were created but are not shown.) The color scheme for heatmapping in this view would typically be:

-

Red boxes indicate a capability planned to be the top third of the planned spend for the next horizon (based on the aggregation from step #3).

-

Yellow boxes indicate a capability planned to be the middle third of the planned spend for the next horizon.

-

Green boxes indicate a capability planned to be the bottom third of the planned spend for the next horizon.

-

Gray boxes indicate a capability for which no project investment requests were submitted and thus there is no planned spend for the next horizon.

Results

This objective, data-based analysis illuminated an entirely new set of insights for the portfolio leadership committee by taking an enterprise capability perspective. It highlighted:

-

Misalignment between the organization’s strategy and its planned investments. For example, the bottom-left two boxes in the Organizational Strategy view are not directly related to achieving the organization’s strategy but were planned to be the top third of the investment per the Organizational Investment view.

-

Redundant project investments across portfolios. For example, some of the same or similar solutions were being built in different product or functional areas, where shared solutions could have been leveraged instead. Without a capability lens, this redundancy would not have been identified (and was not previously).

-

Philosophical differences across the organization. For example, the product areas were approaching the delivery of customer experience with different philosophies, assumptions, and mindsets. This led to an inconsistent and fragmented experience for customers that had multiple products from the organization.

The enterprise perspective that capabilities brought to the project portfolio management process not only shifted the investments that were made for the current horizon but also influenced the entire process going forward. This included:

-

Requiring the owners of each project investment request to indicate the capabilities being enhanced so that the aggregate heatmap views could be readily produced and analyzed

-

Requiring the owners of each project investment request to articulate the business objectives being enabled using a more standard set of metrics defined for each capability

-

Allowing the portfolio leaders to make more informed investment decisions for the enterprise and changing, combining, pausing, or denying project investment requests where applicable

[For a discussion of the book, including its key takeaways and highlights, see: “The Execution Challenge Book Launch Conversation.”]