As part of its ongoing series of flagship CEO Insights research studies, Arthur D. Little (ADL) recently published its 2024 edition: “Positive in an Uncertain World: Confident CEOs Reskill Companies for AI-Driven Growth.” In this Advisor, we explore two key trends revealed through research analysis: while cautious, many CEOs plan to continue their existing growth strategies and are increasing their growth investments.

A Cautious Approach to Growth Strategies

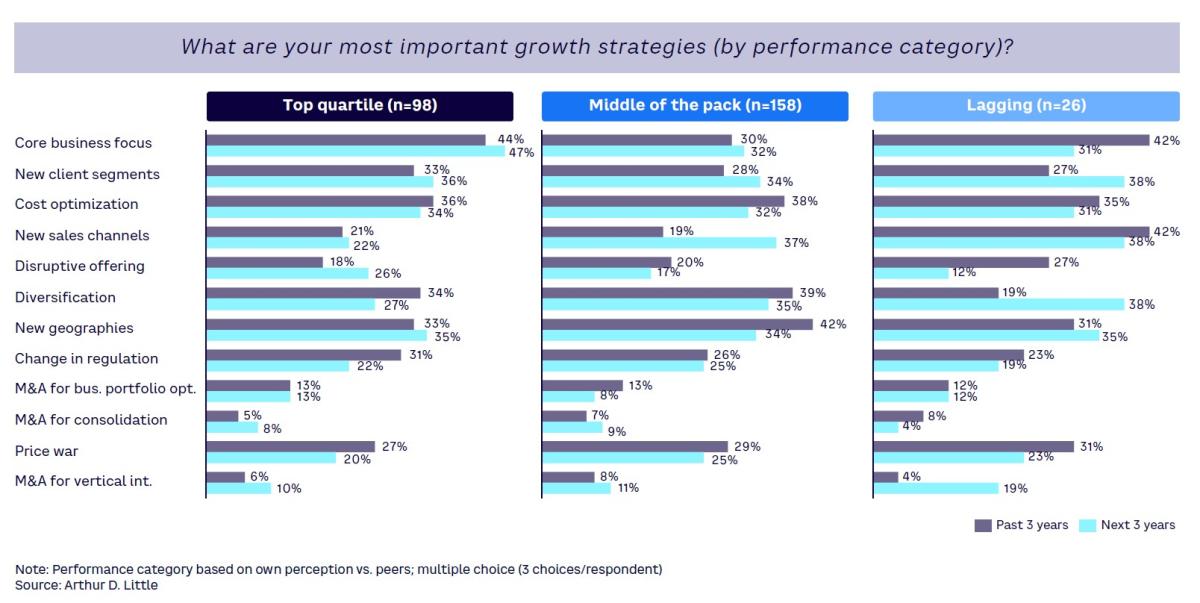

Driven by current market uncertainty, CEOs plan to continue their existing growth strategies, with overall marginal differences between those used for the past three years and the next three years (see Figure 1). The only areas that see a greater focus are diversification (up 14% compared to 2023) and fighting price wars (up 13%), both of which look to be a reaction to economic conditions and more closely fought competition. Providing disruptive offerings (down 9%) and targeting new geographies (down 11%) are being de-prioritized compared to 2023 as CEOs focus on maximizing existing strategies over the short to medium-term.

The future focus on the core business is particularly strong among those companies that see themselves as market leaders, ahead of entering new geographies and cost optimization. For those in the middle of the pack, the focus is shifting to new sales channels (up 18%) and new client segments, showing that they are searching for new opportunities to grow. Among respondents, 38% of laggards are looking to diversify their revenues (doubling from 19% over the past three years), demonstrating a shift away from a core business focus in order to unlock growth.

“Through entering new markets, creating fresh goods and services, and forming clever alliances, we are broadening the scope of our business activities.” — CEO, financial services

Increasing Investments in Growth

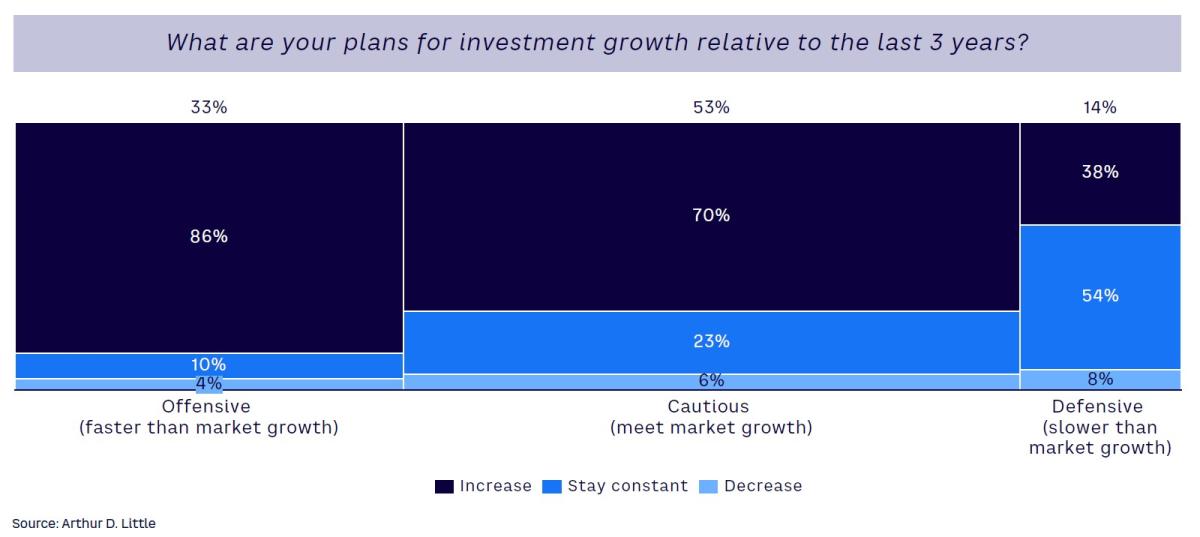

The turmoil of the past 12 months has led some CEOs to recalibrate their growth ambitions (see Figure 2). While a similar percentage (33% versus 30% in 2023) are adopting offensive strategies to achieve faster-than-market growth, the number focusing on cautious strategies (achieve market growth) dropped by 7% as more embraced defensive strategies (aiming for slower-than-market growth). This increase in defensive strategies could also indicate a belief that AI can reduce barriers to entry and bring disruption and new players into existing markets. Larger companies are more likely to be pushing for above-average growth, with 45% adopting offensive strategies compared to 26% of smaller organizations.

What is striking is that across all three groups, CEOs are willing to increase their investments in growth, perhaps pointing to greater funds being required than initially thought necessary to achieve success. For example, 92% of defensive CEOs expect to increase or keep their growth investment constant.

“We recognize the importance of building strong partnerships and collaborations. In times of uncertainty, having a network of reliable partners can provide additional support and resources.” — CEO, healthcare