As part of its ongoing series of flagship CEO Insights research studies, Arthur D. Little (ADL) recently published its 2024 edition: “Positive in an Uncertain World: Confident CEOs Reskill Companies for AI-Driven Growth.” In this Advisor, we explore the first of four key trends revealed through research analysis: CEOs are positive and confident about the future and forecast growth for their companies.

Positive Future Outlook — Significant Shift in Confidence

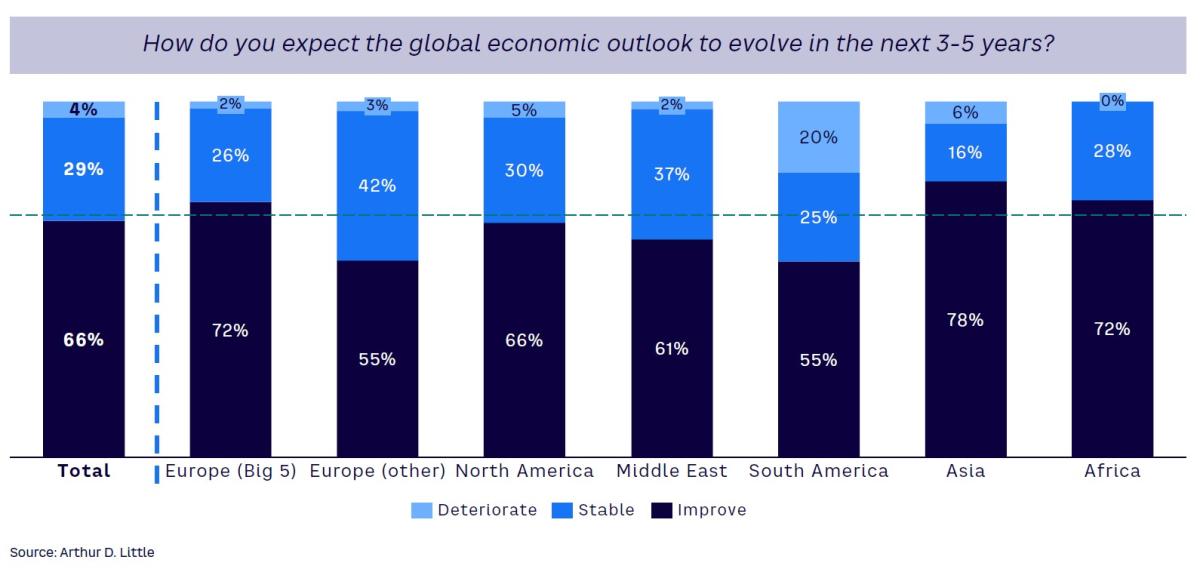

The last 12 months have seen CEOs face an expanding range of challenges, from conflict and geopolitical rivalry to rising costs. Despite this, the headline finding is that CEOs are positive and confident about the medium-term (three to five years) economic outlook (see Figure 1).

Two-thirds (66%) expect a positive global outlook — compared to just 22% in 2022 — implying that they believe the bottom of the market has already been reached or will be reached shortly. Just 4% forecast a deterioration in the global economic outlook, compared to 37% last year. Optimism is even stronger among larger ($10 billion+ revenue) companies, where 84% expect the medium-term outlook to be positive, against 60% of their smaller peers.

Global Confidence, Regional Highlights

This turnaround in optimism is strongest in Asia, where three-quarters (78%) of CEOs forecast positive growth, compared to 10% in 2023. CEOs within the Big Five economies of Europe (France, Germany, Italy, Spain, UK) were equally bullish, with 72% predicting positive global growth, nearly doubling from 38% in 2023. Even in the least positive regions (Latin America and Europe outside the Big Five), a majority of CEOs predict medium-term global growth.

Stable Perspective on External Growth Factors

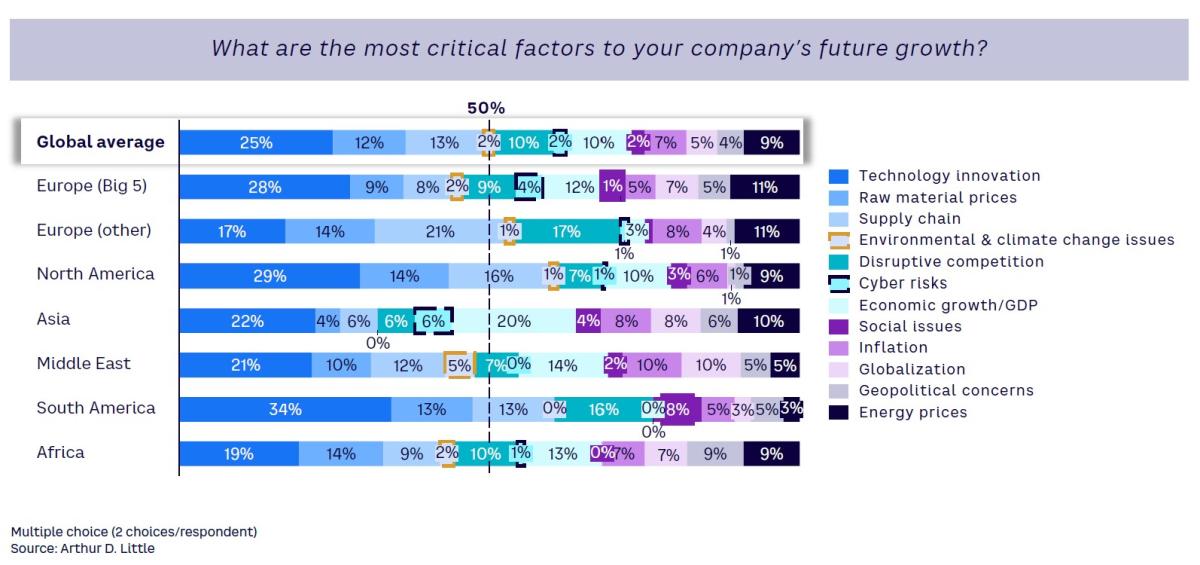

When asked to name the most critical external factors impacting their company’s future growth, CEOs generally focus on the same themes as a year ago (see Figure 2). Technology innovation, including artificial intelligence, remains the most critical factor globally to drive growth. However, concerns over supply chain stability have been overtaken by a need to cope with rising raw material prices, including energy costs. Globally, this has nearly doubled from 11% to 21% in the past year. This trend is particularly strong in Europe and North America though its importance has dropped in the Middle East, potentially due to easier access to energy resources (e.g., oil and gas).

Over the same period, the perceived criticality of environmental issues has dropped from 10% to 2%, perhaps due to more advanced and integrated ESG (environmental, social, and governance) strategies being put in place. CEOs highlight social issues as among the least relevant factors to their growth, with just 2% seeing it as critical.

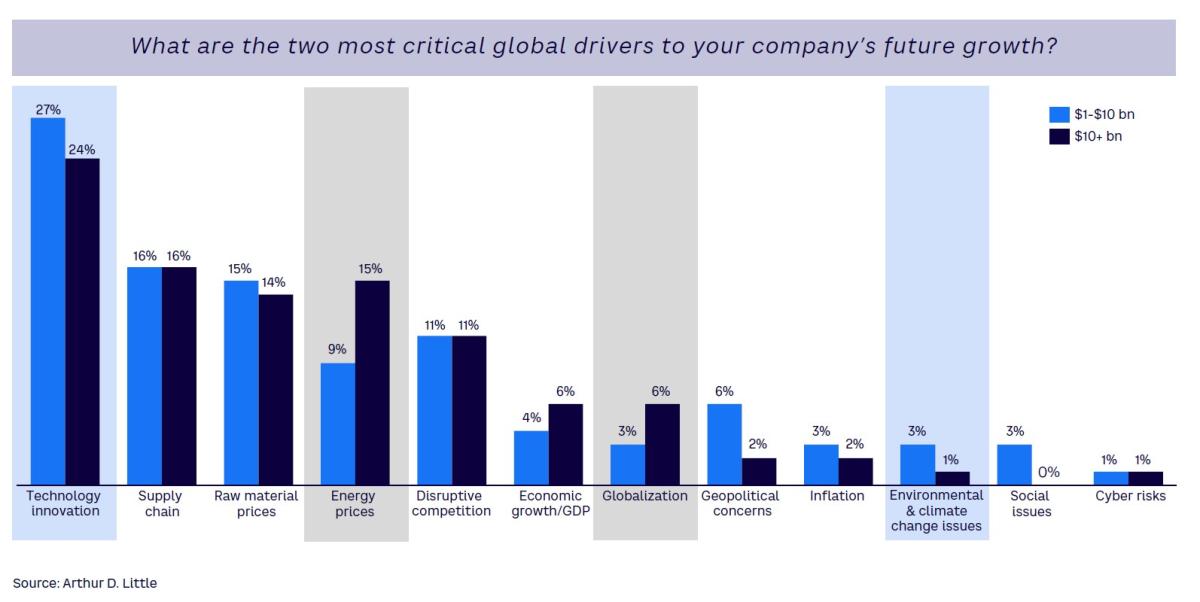

Examining growth factors by company size, CEOs of larger organizations express the greatest concern around energy prices, as well as seeing supply chain and globalization challenges as more critical to growth (see Figure 3). Organizations between $1-$10 billion have a higher focus on technology innovation as a driver but also worry more about geopolitical concerns.

When reporting the drivers that would have the least impact on growth, environmental and climate change issues and social issues were among the bottom three for organizations in both groups.

Our objective is to leverage technology in order to benefit from increased operational efficiency, data insights, and improved decision-making during periods of high volatility.

— CEO, energy & utilities