AMPLIFY VOL. 37, NO. 3

Mobility as a service (MaaS) has the potential to deliver more sustainable, resilient, and human-centric mobility for the world, but significant barriers remain. Based on our experience as strategy consultants advising cities and public/private MaaS operators, vendors on the development of MaaS concepts and solutions, and entrepreneurs driving MaaS deployments, we’re taking a fresh look at these hurdles and what cities can do to overcome them.

MaaS aims to encourage the use of more sustainable transport modes, moving the world away from individual car use “by default.” MaaS promises seamless access to a wide array of mobility options to meet differing needs alongside increased simplicity and convenience in planning, booking, payment, getting information, and access to services for all passengers (see Figure 1). From the perspective of cities and authorities, in addition to encouraging more sustainable mobility patterns and improving accessibility, MaaS could allow system-level asset optimization. For mobility service providers (MSPs), a MaaS framework could lead to better customer engagement, more tailored offerings, and reduced customer-acquisition costs.

(source: Arthur D. Little)

Where Is MaaS Today?

Many MaaS implementations to date have been limited to one-size-fits-all travel planners (i.e., not focused on specific use cases), with a limited number of MSPs being fully integrated in terms of ticketing and payment and others only partly integrated.

However, we are seeing some interesting trends, including a general move away from business-to-customer (B2C) models that are financed with private capital toward a government-to-customer (G2C) one led by public transport authorities or operators. The difficulties behind the MaaS B2C model are well illustrated by the fate of MaaS Global (the most prominent example of this model). After several attempts to shift its business model, MaaS Global filed for bankruptcy in March. Although most G2C schemes are still “walled gardens” in terms of data sharing, there are signs of a shift toward open, public MaaS platforms accessible to third parties, as pioneered in Vienna, Austria, (Upstream Mobility) and now in the Netherlands (Rivier) and possibly later in Brussels, Belgium.

Business-to-employee (B2E) models have seen some positive evolution over the past two years, especially in Western and Central Europe triggered by fiscal incentives, and several vendors and B2C players are pivoting to this model. We are also seeing a rise in MaaS B2C models targeting specific use cases with better returns, such as tourist MaaS (e.g., Alpine Pearls) and rail/aviation MaaS (e.g., Doco by Renfe in Spain and AirAsia MOVE).

Another B2C variant involves mobility services offered as an integrated feature of another set of services, such as insurance, rent (business to tenant), banking (sometimes called “mobility as a feature”), or within super apps. Some promising rural MaaS applications focus on accessibility, in which the business case is more about cost savings for regional authorities than new revenue streams.

There have been positive efforts to evolve regulations, standards, and codes of practice to accelerate MaaS deployment and ease relationship management across various stakeholders, including Multimodal Travel Information and Multimodal Digital Mobility Services in Europe. Nevertheless, expansion has been slow overall, and MaaS-powered trips still represent only a tiny proportion of mobility trips worldwide.

We must conclude that, up to now, MaaS has not delivered on its promise. In terms of the Gartner hype curve, MaaS is probably close to the Trough of Disillusionment (see Figure 2). Whether, and how, it can climb the Slope of Enlightenment is the key question.

What Are the Root Causes of Slow Progress?

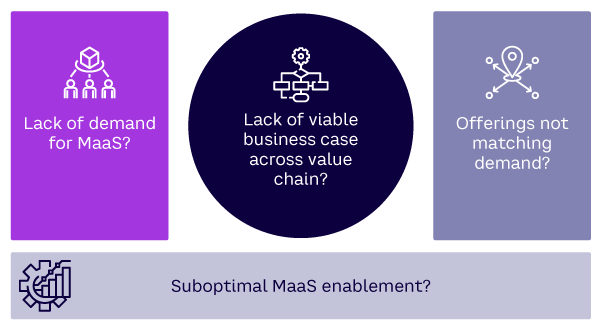

When attempting to verify the impact of MaaS, we run into two problems: (1) a lack of large-scale implementations to date and (2) a lack of proper evaluation of pilots and current operations that are not sharing data. From our experience, we have analyzed the possible root causes for MaaS falling short of its promise. These causes fall into four categories (see Figure 3):

-

Lack of demand for MaaS. Demand for good public transport is high, but it does not cover all the needs of users (e.g., door-to-door travel). Another rare example with high demand — and willingness to pay — is micromobility, especially e-scooters, e-bikes, and bikes. The percentage of intermodal trips in cities (using different modes in one journey) is typically less than 5%, excluding walking, but there seems to be strong demand for multimodal life (using different modes for different journeys), which is something that MaaS can facilitate, leading to higher demand.

-

MaaS offerings not matching demand. Here, one of the main failings is insufficient investment in the necessary physical solutions and infrastructure to provide the required service and customer experience, in addition to the digital components of MaaS. A second issue is that the accessibility, reliability, relevance, and pricing of the included mobility services are often not attractive enough individually, and a MaaS offer can only be so much more attractive than its components. Finally, MaaS offerings are often too generic, failing to match specific customer use cases.

-

Suboptimal enablement. The lack of collaboration between traditional public transport operators (PTOs), MaaS providers, and third-party MSPs is a major barrier to MaaS deployment. Few PTOs have opened their systems for third-party ticket reselling, and even fewer allow reselling of monthly passes or flexible tickets/subscriptions. Current regulations don’t support such collaboration.

-

Lack of viable business cases. Apart from specific use cases, the business case for MaaS operators is challenging due to low margins and difficulties in building sufficient volume. The lack of volume and high levels of competition also make it challenging for MaaS vendors, limiting their ability to invest. Apart from micromobility players, most MSPs don’t see the value in being integrated into MaaS services: it involves having to give up precious margins, and the current MaaS scope does not necessarily cover their customers’ needs. There’s money to be found in the economy of car ownership, which is something that MaaS still needs to tap into — subscription-based services can create value for all parties, but these are currently a hard sell.

What Can Cities & Authorities Do?

Moving ahead requires a more comprehensive approach to framing and enabling a virtuous mobility system powered by MaaS, as well as increased collaboration between public and private stakeholders.

Cities and authorities cannot bring about such a system on their own, but they play a key role in setting priorities to help fully extract value at the system level. Working out how to prioritize efforts in a tight funding environment is difficult. The Arthur D. Little (ADL) MaaS 360 review framework identifies six dimensions that together can drive progress (see Figure 4). They include:

-

Framing dimensions such as reviewing mobility vision, strategy, and funding considering mobility patterns and system characteristics, creating the right conditions for MSPs, investing in infrastructures, and promoting/ensuring the progressive deployment of MaaS offerings that cater to relevant customer use cases.

-

Enabling dimensions such as technical development and support, regulations that allow open collaboration across players and incent more sustainable behaviors, and programs that ensure learnings from experimentation are extracted and shared to foster continuous improvement.

Conclusion

Although MaaS has yet to deliver on its promise, there are huge benefits ahead that justify continuous efforts. As with most innovations, first steps are taken by targeted use cases, not one-size-fits-all offerings. Progress will require a more comprehensive approach to frame and enable a virtuous mobility system powered by MaaS, as well as increased collaboration between public and private stakeholders. Cities, transport authorities, and PTOs have a significant role to play in extracting value at the system level and unlocking MaaS’s full potential.