AMPLIFY VOL. 37, NO. 3

The importance of sustainability in the mobility sector is coming to the forefront of the global agenda, driven by the urgent need to reduce CO2 emissions. Sustainable mobility concepts can minimize environmental impact and significantly improve quality of life in urban areas by promoting transportation modes that consume fewer resources and produce lower emissions.1

The transportation sector significantly contributes to environmental and societal issues, particularly through the use of private vehicles. Air pollution, noise, congestion, and the extensive use of valuable urban space for parking are just some of the adverse effects of traditional transportation systems. These issues underscore the need for more sustainable and efficient mobility concepts.

Given the global climate crisis, reducing CO2 emissions in the transportation sector is crucial. To achieve the goals of the Paris Agreement and avert the worst impacts of climate change, effective measures must be taken now. This requires new transportation concepts and the promotion of environmentally friendly, sustainable mobility forms.

Traditional mobility faces numerous challenges, including inefficiencies, congestion, and an inability to meet the growing demand for urban mobility with existing road capacities. These challenges require innovative solutions that improve efficiency and promote sustainable transportation infrastructure.2

One aspect of sustainable mobility is vehicle-sharing systems, which ensure that the last mile is covered. These systems increase the use of existing vehicles and reduce the total number of cars by replacing private cars. Vehicle-sharing systems contribute even more to a sustainable strategy if they are electric (significantly reducing CO2 emissions).

In this article, we focus on car-sharing systems and distinguish between one-way/free-floating and two-way car-sharing systems. In one-way car-sharing systems, the customer can pick up the car at one station and drop it off at any other station, or at the same station. In free-floating car-sharing systems, the customer can pick up the car and drop it off anywhere in the business area. In two-way car-sharing systems, the customer must drop the car at the same station where they picked it up. We focus on free-floating systems as the most flexible and convenient alternative to private cars, facilitating more efficient vehicle use and potentially reducing road density and thus CO2 emissions.

Balancing with Relocation

Free-floating car-sharing providers face a major challenge: the imbalance of vehicle distribution caused by uneven travel patterns. This results in an accumulation of cars at popular destinations and a lack of cars at popular origins. As a result, the system can no longer meet demand and may lose customers. One solution to this imbalance is relocation.

We distinguish between operator-based and user-based relocation: operator-based relocation involves relocation of vehicles by employees; user-based relocation is performed by customers who are incentivized by pricing. Operator-based relocation has several drawbacks: it causes additional CO2 emissions during relocation, increases operational costs, and is inefficient because vehicles are blocked during this relocation time. In contrast, user-based relocation does not generate additional CO2 emissions or operational costs.

This article focuses on the development of a profit-maximizing dynamic pricing model for free-floating car-sharing systems. Our approach is customer-centric and leverages stochastic dynamic programming to anticipate future vehicle locations, rentals, and profits. By considering customer locations and disaggregated choice behavior in price optimization, we can accurately capture the effects of price and walking distance on the likelihood of vehicle selection by the customer. This origin-based, anticipative, dynamic-pricing approach not only enhances profitability, it helps providers overcome the major challenge of free-floating car-sharing systems.3

Dynamic Pricing & Modeling

This section describes an anticipative customer-centric pricing approach developed in a joint project with German car-sharing company Share Now. The core idea is to avoid imbalances not through relocation, but by using intelligent, customer-centric, dynamic pricing to incentivize customers to achieve a more balanced distribution of vehicles (sometimes called “user-based relocation”).

The approach is based on a complex, data-driven model that considers the interplay between supply and demand in a business area, predicts future vehicle movements and the expected profit of each vehicle, and uses machine learning and AI to combine various data sources (e.g., vehicle GPS data, anonymized demand data).

The innovative aspect of this pricing approach is that it is customer-centric and dynamic. This is not the case with the pricing approach of other vehicle-sharing providers. Customer-centric dynamic pricing means that when a customer opens the provider’s mobile application to rent a vehicle, the price optimization incorporates the customer’s location as well as detailed (sometimes called “disaggregated”) choice behavior to precisely capture the effect of price and walking distance on the customer’s probability of choosing a vehicle.4

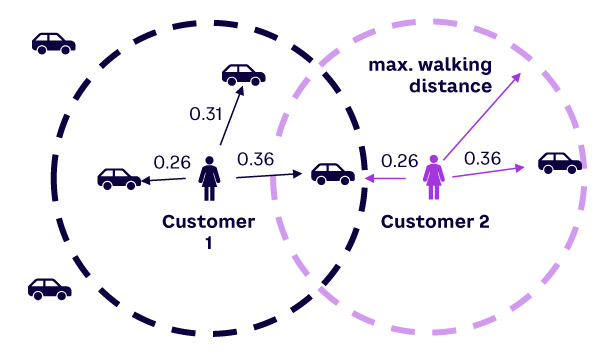

In contrast to other approaches, customer-centric pricing can result in different prices for the same vehicle for different customers, depending on their location. Figure 1 shows two customers opening the application at different locations. Both have a similar maximum walking distance (meaning they only consider cars within their respective walking distance). Both customers consider the car at the intersection of both walking areas. The system shows Customer 1 a price of €0.36 per minute; Customer 2 sees a price of €0.26 per minute.

Two other features distinguish this approach: (1) it is origin-based, meaning that prices are differentiated by origin location and origin time, which reflects the situation of many car-sharing providers, such as our practice partner Share Now; and (2) it is anticipative, as it stochastically predicts the impact of the current pricing decision for future profit using approximate dynamic programming.

The provider operates a fleet of cars spread across a business area with the objective of both maximizing profits and being as sustainable as possible. We consider a planning horizon of one day, in which the model is solved each time a customer arrives. Thus, each customer who opens the application receives prices for the cars. Each time the application is opened, the provider dynamically optimizes the prices in real time.

If the customer arrives, the provider knows the current vehicle distribution and potentially reachable vehicles for the customer (vehicles within the specified walking distance). Prices for reachable vehicles are then calculated based on the location of the customer, probability of the customer choosing a vehicle, and current vehicle distribution. The probability of choosing a vehicle is a function of price and distance to the vehicle, which is determined by an advanced customer-choice model.

Model & Algorithm

The model calculates optimal prices by calculating expected profit after a customer arrives. The profit-maximizing has two parts. First, it calculates the expected profit if a customer arrives, opens the application, and chooses a vehicle. This expected profit is divided into two parts: (1) the expected profit for the current rental the customer has chosen and (2) the approximate expected future profit generated by the entire system after a vehicle has been chosen. The second part of the equation considers the expected profit if the customer does not choose a car and disappears.

To improve tractability, we approximate the values for expected future profit. The challenge is to find a suitable approximation; ours is based on the simplification that the overall profit obtained until the end of the day is additive to the future profits of the cars. Thus, the expected future profit after the car has been chosen is approximately the sum of the values (expected profit) of the remaining idle vehicles plus the value of the chosen vehicle. The expected future profit when no car was chosen is approximately the sum (expected profit) of all idle cars.

To determine the values of the cars, we need historical data with information about the location of various cars, the time when they were picked up, and the profit they generated until the end of the day. Thus, for each car in the historical data, we have data about when and where it was picked up and how much profit the corresponding rental generated, as well as when and where each car was dropped off.

Using this historical data, we filter out the car values that are spatially and temporally similar (e.g., within 500 meters of the current location of the evaluated car, represented by the semicircle in Figure 2). To calculate the value of the gray idle car in Figure 2, we consider all idle car values in the spatial and temporal vicinity in the historical data (all crosses within the semicircle). We then weight the historical car values according to their spatial and temporal similarity.

For example, to evaluate the gray idle car, we consider the purple and black crosses within the semicircle, which represent different car values of idle cars at different times and locations. The car value of the first black cross is given a higher weight because it is closer in space and time to the gray idle car than the first purple cross. If the gray car departs, the vehicle is evaluated analogously.

Results

To illustrate the benefits of our dynamic pricing approach (C-ANT) over other benchmarks, we carried out several computational studies and a case study using Share Now data from the city of Vienna, Austria. We considered three benchmarks. The first is a unit price (BASE). Thus, the provider does not differentiate the price. The second is customer-centric myopic pricing (MYOP), which does not consider the expected future profit. The third is non-customer-centric (i.e., location-based) anticipative dynamic pricing (L-ANT).

In an extensive computational study, we examined the developed approach and the benchmarks in realistic settings with varying business area and fleet sizes as well as varying demand patterns and overall demand levels, indicated by the demand-supply-ratio (i.e., the maximum period demand divided by the fleet size).

Setting

We assumed a planning horizon of one day. The demand patterns we used replicate what is observed in practice: demand intensity varies over the course of the day with two peaks. There is also a spatial variation of demand (e.g., between the city center and outer areas). Across all settings and demand preferences, we considered three or five possible prices (in the case study), as car-sharing providers aim for a transparent, easy-to-communicate pricing mechanism. These prices are predefined based on typical prices in practice.

Profit Impact

We divided the results into two categories: profit and sustainability implications. The numerical results of our computational study show the C-ANT approach provides the highest profit for all settings and demand levels.

When compared to MYOP, we found that anticipative approaches (C-ANT and L-ANT) result in a higher fluctuation of prices across the business area. This is because they can consider future vehicle distribution and rentals in their pricing approach, allowing them to incentivize user-based relocations by varying prices in time and space.

For instance, in all peripheral areas, relatively low prices are set in the morning to incentivize customers to drive vehicles to the center, where demand is comparatively high. Furthermore, taking situation-specific customer information into account enables our approach to better adapt incentives to the customer’s choice behavior.

Due to its ability to anticipate the spatiotemporal demand asymmetries and incentivize user-based vehicle relocations, C-ANT leads to a distribution of vehicles that is better aligned with demand. Immediately before the afternoon peak at 17:30, C-ANT manages to have more vehicles in the center of the business area where demand is strongest at this time compared to the benchmarks.

Regarding possible interdependencies between vehicle distribution and profits, we concluded that very low prices, especially in the outer areas during morning hours, can be successfully used as a customer incentive and can lead to higher profits later in the day when the vehicle distribution is better synchronized with demand.

The results of the numerical study and the case study confirm the benefits of the customer-centric dynamic pricing approach, which outperforms all considered benchmarks significantly, particularly with regard to realized profits and the spatial distribution of vehicles. An analysis suggests that the anticipation of future states and profits, together with the implementation of customer-centricity, is the main driver of its performance.

Sustainability

Although profit maximization is the objective of the optimization problem and the most important metric from the perspective of car-sharing providers,5 the customer-centric dynamic pricing approach can make a significant contribution to a provider’s sustainability performance due to the reduced need for operator-based relocations.

Profit maximization does not have to be traded against sustainability considerations, as both targets can be considered by anticipating spatiotemporal demand variation in pricing, incentivizing customers to drive from low-demand to high-demand locations. The incentivization of user-based relocations via a customer-centric anticipative dynamic pricing approach improves profitability compared to alternative approaches while reducing the need for operator-based relocations. Providers not only save operational costs incurred by additional staff and equipment, they can reduce CO2 emissions and fuel consumption caused by “unnecessary” rentals or relocations.

To summarize, the customer-centric anticipative dynamic pricing approach for free-floating car-sharing systems performs considerably better in comparison to existing approaches in terms of relevant performance metrics and potential for improving sustainability.

The System in Practice

Share Now started with unit pricing for identical vehicles. In 2019, as a first step, it implemented static pricing, where the price is a function of the time and location of the rental’s origin. To do so, it used either a predecessor’s approach or our approach.

Next, Share Now wanted to implement dynamic pricing. It tested the customer-centric dynamic pricing approach in its digital twin, and the results were consistent with our findings. Back then, Share Now was a Mercedes Benz-BMW joint venture. After its recent sale to Stellantis, Share Now has some different preferences, so the dynamic pricing approach has not been implemented. We believe the process will restart this year.

The advantage and practicability of customer-centric dynamic pricing is that it does not have to be adapted for geographic regions or sharing providers (e.g., scooter sharing, bike sharing) because it is based on historical data of the geographic region or provider and thus implicitly considers the characteristics of the sharing system or geographic features. It can easily be transferred to other vehicle-sharing providers or regions.

Conclusion

This article described a profit-maximizing dynamic pricing model for free-floating car-sharing systems to counter the uneven distribution of vehicles, thus increasing the system’s sustainability and efficiency by incentivizing user-based relocations.

After a customer opens the provider’s mobile application, the system calculates the optimal prices. The probability of choosing a vehicle is a function of price and the customer’s distance to the vehicle. We approximated the overall expected future profit by the sum of the expected future car profit. To determine the approximated future car profit, we used historical car values, which we weighted according to their spatial and temporal similarity.

In an extensive computational study as well as a case study, we demonstrated that our new pricing approach significantly outperforms all benchmarks. These results show that integrating anticipation and customer-centricity into dynamic pricing in car sharing leads to significant profit improvement across all settings and demand preferences.

Compared with the benchmarks, the anticipative customer-centric dynamic pricing approach leads to a vehicle distribution that is more balanced and better synchronized with demand (e.g., it raises prices in an area in the early morning if it anticipates a shortage of vehicles around noon).

The incentivization of user-based relocation via a customer-centric dynamic pricing approach improves profitability compared to alternative approaches while reducing the need for operator-based relocation. Regarding the objective to align future demand and supply, user-based relocation offers a favorable alternative to operator-based relocation in terms of both economic and environmental concerns.

From a sustainability perspective, user-based relocation not only helps providers save operational costs incurred from additional vehicles and staff, but it also reduces CO2 emissions and fuel consumption generated by “unnecessary” operator-based relocations.

References

1 Schulte, Frederik, and Stefan Voß. “Decision Support for Environmental-Friendly Vehicle Relocations in Free-Floating Car Sharing Systems: The Case of Car2go.” Procedia CIRP, Vol. 30, 2015.

2 Ramos, Érika Martins Silva, et al. “Mobility Styles and Car Sharing Use in Europe: Attitudes, Behaviours, Motives and Sustainability.” European Transport Research Review, No. 12, No. 13, 2020.

3 Firnkorn, Jorg, and Martin Müller. “What Will Be the Environmental Effects of New Free-Floating Car-Sharing Systems? The Case of Car2go in Ulm.” Ecological Economics, Vol. 70, No. 8, June 2011.

4 Müller, Christian, et al. “Customer-Centric Dynamic Pricing for Free-Floating Vehicle Sharing Systems.” Transportation Science, Vol. 57, No. 6, November 2023.

5 Pantuso, Giovanni. “Exact Solutions to a Carsharing Pricing and Relocation Problem Under Uncertainty.” Computers & Operations Research, Vol. 144, August 2022.