AMPLIFY VOL. 37, NO. 5

Traditional banks are facing increased competition from digital “challenger banks” and “neobanks,” which offer traditional banking services online and through mobile applications, rather than high street branches. These new entrants are much further along the analytics maturity journey than traditional banks.

Banks hold large quantities of data relating to customer transactions and financial data, including income and spending activity, financial product holdings, financial history, and demographics. Increasingly, data is collected from digital sources, such as mobile applications and online banking systems, with open banking expanding this trend. This big data can be used to improve decision-making and innovation, but it requires the bank to possess or develop important resources and capabilities.

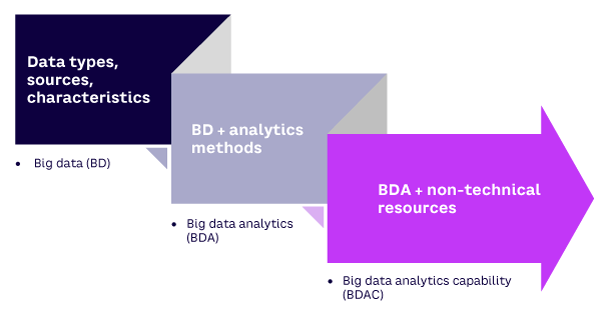

The definition of big data analytics capability (BDAC) has evolved over time, reflecting the realization that gaining value from big data is a wider organizational capability rather than something entirely reliant on data and technical resources.1 As shown in Figure 1, the initial focus was on the characteristics of big data, including its volume, variety, velocity, veracity, and value.2 The focus then moved to big data analytics, which also emphasizes the tools and methods used to analyze this big data.

More recent conceptualizations focus on combining these elements alongside a wider resource base, including talent, a data-driven culture, and organizational learning. These technical and nontechnical resources can be combined to strategically leverage data to gain actionable insights and drive innovation, leading to a widening definition of BDAC.3 This shift highlights that value gained from big data extends beyond the IT department and requires change across business functions.

Key Elements of BDAC: Technology, People & Culture

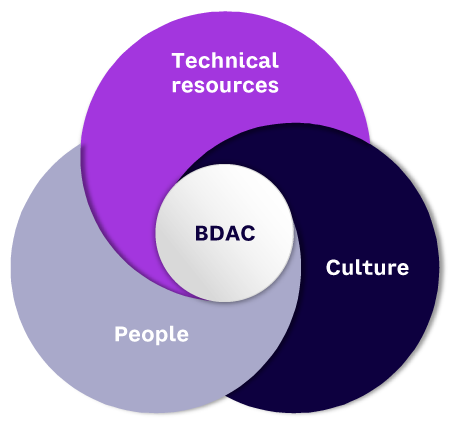

Organizations aiming to develop a BDAC or increase the maturity of an existing BDAC can evaluate their current status across three key resource and organizational elements, as illustrated in Figure 2. The first resource type is technical and includes both data and the tools/infrastructure to build an analytics platform (i.e., a “single source of truth” for analytics purposes). The second type is the people aspect, which refers to data professionals with the requisite skills and leadership. The third resource is an organizational culture that is change-oriented and data-driven, in both data and non-data roles.

In addition to these BDAC resources, effective resource orchestration is required via organizational processes and structures that harness these resources effectively in the development and deployment of BDACs. These are highlighted below.

Technical Resources: Data & Technology

Central to any analytics project are the technologies used to process, store, and analyze the data. In the case of BDAC, this data is large and complex. Digital transformation means that traditional structured data is only one of many types, and firms can now draw on more novel big data sources.

Big data is defined by the “5 Vs” mentioned earlier: volume, velocity, variety, veracity, and value.4 Volume is the most intuitive V, referring to the size of the data created by digitization. Velocity refers to the speed at which data is created, reflecting the increased generation of streaming data from sources such as sensors, as well as high-velocity transactional data from sources like credit cards and the stock market.5 Variety refers to the data being in many forms, including structured data that fits neatly into rows and columns and unstructured data from sources like text, images, and video.6 The veracity (or quality) of the data is also an important consideration, as poor data quality can result in misleading outputs. Crucially, the data should result in business value, highlighting that the data should be viewed as a firm asset.

Technologies are needed to store, process, and analyze the data. Data is often generated from multiple internal and external sources and therefore needs to be combined in a central data warehouse or data lake to maximize value by combining various data sources, rather than operating across isolated data sets or systems.

As a first step in data analysis, reporting and visualization tools can be used to generate descriptive analyses of current and past key performance indicators (KPIs) and trends. Modern business intelligence solutions typically enable reporting automation and self-service dashboards, reflecting the democratization of analytics across the organization. More advanced predictive and prescriptive analytics tools have traditionally focused on coding languages, such as Python and R. Alongside coding languages, a range of more user-friendly, drag-and-drop tools have been developed to democratize and increase the efficiency of the analytics process.

People Resources: Data Professionals

Data professionals with the right skills and mindset are required to generate value from big data. This includes data analysts, data engineers, and data scientists. Alongside the technical skills needed to work with the data and tools, there is an increasing recognition that softer skills are required, such as business domain knowledge, curiosity, and problem-solving. Finding staff with this range of skills is challenging; this type of idealized data scientist is sometimes referred to as a “unicorn.”7

Although data professionals are essential, a broader level of data literacy and data democratization across business functions can help an organization become more data-driven. Businesses are moving toward data democratization by providing access to data and analytics tools throughout the organization. The development of no-code/low-code analytics tools and AutoML (automated machine learning) has created opportunities for a broader range of less technically orientated staff to engage in analytics, resulting in “citizen data science,” in which non-data scientists are involved in tasks previously restricted to data scientists and engineers. These trends require upskilling the workforce to increase data literacy.

Cultural Resources: Data-Driven

Vast amounts of data can be collected, but if reliance on human intuition prevails over data-led decision-making, the benefits of BDACs will not be achieved. Culture is an intangible resource, created and transmitted by people. It is a way of “thinking, feeling, believing.”8 Much like gravity, we cannot see culture, but it is there.

A data-driven culture requires decision-making based on data and analytics, rather than relying only on human judgment and intuition. This means data is viewed as an asset, with behaviors and practices based on a shared belief that data plays a key role in an organization’s success.9 The goal is for data to be embedded in the organization such that employees think in a data-first way, replacing the words “I think” or “I assume” with facts and quantitative statements based on data.

It is important to promote the use of data across a firm so that insights are not just sought after but used to get the full benefit of BDACs. Non-data roles in the firm should also understand the importance of a data-centric approach and good data quality, as well as the value of good data questions.

Assessing & Developing Resource Base for BDAC

Firms are at varying levels of analytics maturity, but traditional banks have a lower level of analytics maturity than their digital, technology-driven counterparts. Regardless of maturity stage, an audit of current resources with the correct stakeholders can allow a firm to establish its resource position when planning a data strategy.

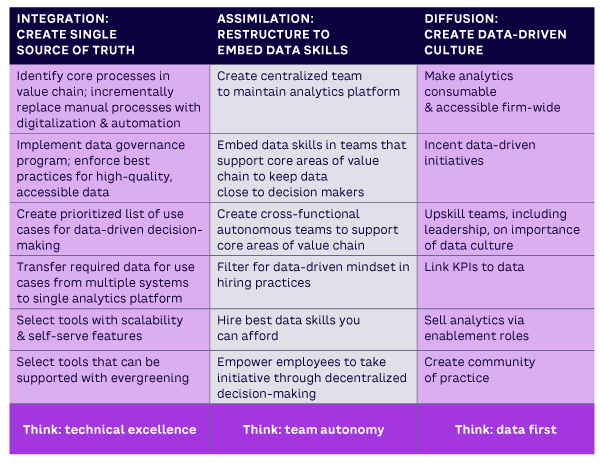

An “as is” snapshot of the firm’s current position can be contrasted with a “to be” position, and the resulting gap analysis can be used to identify required resources. This can inform the second part of the task: active resource orchestration by managers via integration, assimilation, and diffusion (which will vary by firm).

The key processes that help synergize the bundling of BDAC resources are summarized in Table 1.

Integration

The goal of the integration process is to create a single source of truth for analytics. Processes of digitalization and automation are required to capture and store a variety of data sources in a timely fashion. With legacy systems in place, traditional banks typically have less digitalization and automation. An incremental, iterative approach is required in such cases to prioritize key aspects of the customer journey and replace manual data collection and storage processes with digitalization and automation. Data can then be taken from source systems, via extract, transform, load (ETL) processes, and stored in a single location for analytics, such as a data warehouse.

Data quality is an important aspect here, and firms need a robust data governance program to ensure high-quality, reliable, accessible data. Firms must also select the best tools for analytics purposes, including a visualization tool that’s scalable and promotes self-serve capabilities so those in data and non-data roles can be close to data for decision-making. An “evergreening” program ensures that tools are constantly renovated so they are always fit for purpose. Think: technical excellence.

Assimilation

The goal of the assimilation process is to introduce and distribute data skills in the firm in support of analytics development and deployment. Ideally, excellent-quality data and robust tools that bring data closer to decision makers across the firm will enable team autonomy and remove external dependencies on accessing data for decision-making.

The first step is to reorganize the teams, making sure each team has the data skills it needs and that its leaders put a strong emphasis on the importance of data. A centralized team should drive best practices and standards, including data quality and storage, governance, and tooling approaches. Outside this centralized data team, individual product or service areas should have data skills embedded, with a cross-functional, autonomous team supporting each product or service area. This way, the data team has the domain-specific knowledge needed to support team goals and an understanding of data and tooling standards from the central team. Upskilling will be required, alongside hiring practices that filter for a data-driven mindset in employees. In the early stages of BDAC development, firms should hire the best data skills they can afford and reward accordingly. Think: team autonomy.

Diffusion

The goal of the diffusion process is to develop and maintain a data-driven culture. The processes of integration and assimilation enable this state, in which analytics are available for decision-making across the firm. Data must be accessible and consumable firm-wide, and it must be achieved via tools that promote data democratization.

A data-driven culture can also be incented via data-driven strategic initiatives, with upskilling at all levels of the firm to improve data literacy, including leaders who can set an example. Team- and firm-level KPIs can be linked to data goals and measured in a data-centric way. Data-enablement roles can be introduced to champion the use of data by showcasing the benefits of a data-driven culture and talking about successful use cases both within the firm and outside. Communities of practice are a key feature of firms with a data-driven culture, enabling knowledge sharing and collaboration by drawing together a critical mass of data-driven employees. Think: data first.

Internal & External Drivers of BDAC Development & Deployment

Firms with developed BDACs gain strategic competitive advantage through improved decision-making and innovation. In banking, firms have developed BDACs to increase operational efficiency and performance and in response to external drivers, such as competitive pressures, regulatory requirements, and external shocks. Once developed, a BDAC can be deployed to carry out analytics at various levels, including descriptive, predictive, and prescriptive.

Gaining Efficiency

In the banking sector, analytics are often used to gain operational efficiencies, such as automating the customer due diligence process, which helps save on staffing costs. Analytics can help leaders decide which branches to close, measure the success of product lines, and understand outcomes by measuring customer satisfaction. Data-driven KPIs can be used to monitor a range of targets, from employee performance to quarterly team goals.

Reacting to Competitive Pressures

In many countries, retail banking is dominated by large incumbent banks with huge volumes of current and historical customer data. Despite this, they have often been slow to embrace advanced analytics. Digital disruptor banks are entering the market, offering similar banking services but through digital mobile applications. They are capturing a variety of near-real-time data, such as customer interactions, and using this for product development. To keep pace, traditional banks have been increasing their efforts to develop BDACs, including by investing in the underpinning resources discussed previously.

Responding to Regulations & Protecting Customers

New regulatory requirements and changes to existing ones are another important driver of analytics in the banking sector. This can include using analytics to meet standard regulatory returns, as well as advanced use cases like detecting and blocking financial crime by identifying suspicious transactions on customer accounts or optimizing transaction monitoring rules. The introduction of new regulations has also driven banks (incumbents, in particular) to develop BDACs to meet these requirements.

Handling External Shocks

The need for banks to roll out government support schemes quickly during the pandemic meant that projects were completed in a fraction of the time they would normally have taken. The business loan application process moved entirely online, and key tasks were broken down into user stories and simplified to create a digital customer journey. Modular elements from other processes were effectively reused and stitched together. This increase in digitalization allowed for automatic data collection and storage of key customer interactions that previously occurred in person, streamlining the process.

Conclusion

BDAC development in the banking industry highlights several lessons that are broadly applicable. Regardless of analytics maturity level, BDAC requires three key resources from all firms: (1) data and technology resources, (2) people with the requisite data skills, and (3) a data-driven culture. BDAC resources can be synergized via the orchestration processes of integration, assimilation, and diffusion.

The large quantities of data in both traditional and digital banks have the potential to drive strategic value, but data quality and integration from disparate sources remain challenging. Fostering a data-driven culture is important in the development and deployment of BDACs, which require a high level of data literacy across all levels and functions in the organization. Increased data literacy across the organization facilitates data democratization and citizen data science, allowing nontechnical staff across levels and functions to gain value from data.

The banking industry, like other sectors, also has an opportunity to develop BDAC to increase value and gain strategic benefits. The nature of analytics is dynamic, and BDACs need to be continuously updated to keep pace with technological and industry developments.

References

1 Mikalef, Patrick, et al. “Big Data Analytics Capabilities: A Systematic Literature Review and Research Agenda.” Information Systems and e-Business Management, Vol. 16, July 2017.

2 White, Martin. “Digital Workplaces: Vision and Reality.” Business Information Review, Vol. 29, No. 4, December 2012.

3 Gupta, Manjul, and Joey F. George. “Toward the Development of a Big Data Analytics Capability.” Information and Management, Vol. 53, No. 8, December 2016.

4 White (see 2).

5 Gillon, Kirstin, et al. “Business Analytics: Radical Shift or Incremental Change?” Communications of the Association for Information Systems, Vol. 34, 2014.

6 Gillon et al. (see 5).

7 Davenport, Thomas. “Beyond Unicorns: Educating, Classifying, and Certifying Business Data Scientists.” Harvard Data Science Review, Issue 2.2, May 2020.

8 Kluckhohn, Clyde. Mirror for Man: The Relation of Anthropology to Modern Life. Whittlesey House, 1949.

9 Kiron, David, Renee Boucher Ferguson, and Pamela Kirk Prentice. “From Value to Vision: Reimagining the Possible with Data Analytics.” MIT Sloan Management Review, 5 March 2013.