The phrase “data is the new oil” has been bandied about for several years to convey the potential value of data. Not surprisingly, the global business analytics market rose to more than US $96 billion in 2024. Looking forward, the International Market Analysis Research and Consulting Group (IMARC) forecasts that the market will exceed $196 billion by 2033.

Of course, what the British mathematician and data scientist Clive Humby meant when using this phrase is that data, like oil, isn’t useful in its raw state. Data must be sourced, extracted, refined, and processed in order to be turned into something of value for organizations. Business analytics is the systematic process of collecting, analyzing, and interpreting critical business data using a range of advanced statistical techniques, technologies like AI and big data analytics (BDA), and industry-specific software applications.

As organizations move further into the digital era, decision makers, data scientists, strategists, and C-suite teams seek analytical innovations to help their organizations extract and create value (both economic and social) from large, complex data sets to augment decision-making, improve efficiencies, enhance business performance, and enable digital strategizing and implementation.

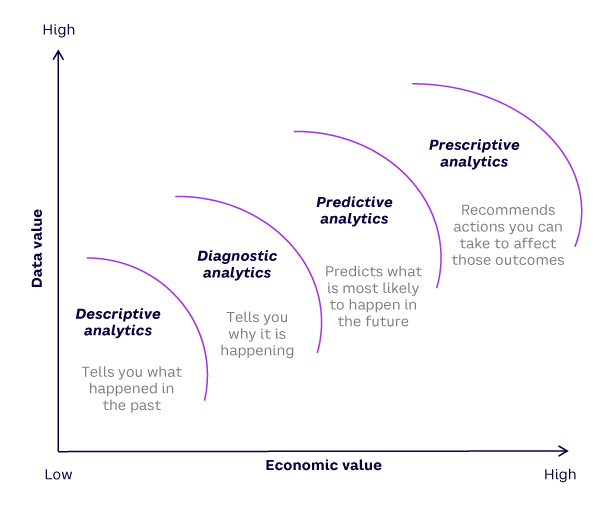

Creating business value, however, requires organizations to learn from the insights generated by their data to make data-driven decisions. Such learning is challenging as, historically, the attention of decision makers was largely on understanding “what” happened using descriptive analytics and “why” it is happening using diagnostic analytics (see Figure 1).

The real economic value of advanced analytics (e.g., AI, BDA) is in sensing and predicting more accurately what will happen and acting to seize opportunities (e.g., changing customer sentiment) or mitigate threats (e.g., supply chain interruptions).

[For more insights on maximizing business value with data analytics, see our full Amplify issue on the topic.]