AMPLIFY VOL. 37, NO. 5

The phrase “data is the new oil” has been bandied about for several years to convey the potential value of data. Not surprisingly, the global business analytics market rose to more than US $89 billion in 2023. Looking forward, the International Market Analysis Research and Consulting Group (IMARC) forecasts that the market will exceed $180 billion by 2032.1

Of course, what the British mathematician and data scientist Clive Humby meant when using this phrase is that data, like oil, isn’t useful in its raw state.2 Data must be sourced, extracted, refined, and processed in order to be turned into something of value for organizations. Business analytics is the systematic process of collecting, analyzing, and interpreting critical business data using a range of advanced statistical techniques, technologies like AI and big data analytics (BDA), and industry-specific software applications.

As organizations move further into the digital era, decision makers, data scientists, strategists, and C-suite teams seek analytical innovations to help their organizations extract and create value (both economic and social) from large, complex data sets to augment decision-making, improve efficiencies, enhance business performance, and enable digital strategizing and implementation.

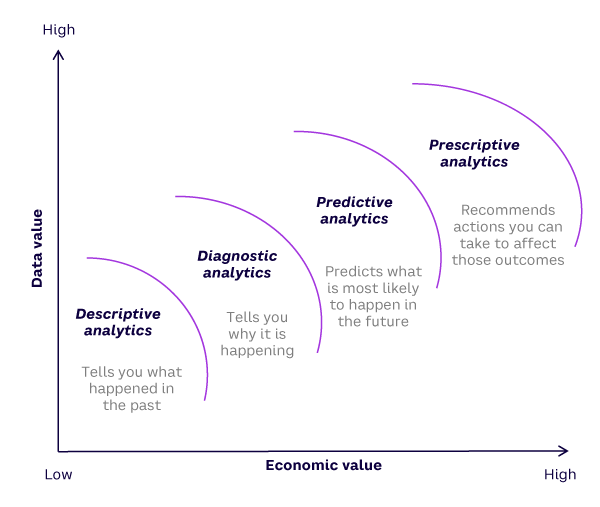

Creating business value, however, requires organizations to learn from the insights generated by their data to make data-driven decisions.3 Such learning is challenging as, historically, the attention of decision makers was largely on understanding “what” happened using descriptive analytics and “why” it is happening using diagnostic analytics (see Figure 1).4

The real economic value of advanced analytics (e.g., AI, BDA) is in sensing and predicting more accurately what will happen and acting to seize opportunities (e.g., changing customer sentiment) or mitigate threats (e.g., supply chain interruptions).

In this issue of Amplify, we explore several ways organizations leverage business analytics to create business value. As we delve into this dynamic business environment, it becomes evident that leaders who understand their business and data and can strategically align their analytical capabilities are best positioned to derive business value.

In This Issue

This issue showcases the relationship between business analytics and business value and provides real-world examples of how analytical technologies can be successfully adopted and adapted to create business and social value in a variety of sectors and industries.

First, Pamela McCloskey and Byron Graham explain “why” and “how” organizations in the banking industry are developing and using big data analytics capabilities (BDAC) to derive business value. Their article highlights the importance of a socio-technical approach to analytics: technical resources (e.g., data, technical infrastructure, software tools) and human capital with the skills to use these resources combined with the right social elements to nurture a data-driven culture that ensures the correct use of data for insight and decision-making. McCloskey and Graham present examples of how organizations have drawn on BDACs to successfully respond to recent shocks in the external environment, including the pandemic and regulatory changes in the financial services industry. The authors’ proposed framework for assessing and developing the resource base for BDAC helps organizations understand their level of analytics maturity to maximize operational efficiencies and performance. The framework outlines how (1) process integration (creating a “single source of truth”), (2) process assimilation (restructuring to embed data skills,) and (3) diffusion (creating a data-driven culture) can enable organizations to develop BDACs to increase business value and gain strategic benefit.

Next, Conn Smyth, Samuel Fosso Wamba, Murray Scott, Sean Coffey, and I take a look at the important topic of resilient agri-food supply chains, an issue that affects us all. We report on the challenges facing the industry and explain how agri-food supply chain organizations are leveraging AI-based systems to plan for, respond to, and recover from supply chain disruptions efficiently and cost-effectively. The results show that AI-enabled information processing can build resilience in agri-food supply chains while reducing food waste and improving supply chain performance. The article is part of a wider doctoral research project and is informed by 147 survey responses from practitioners in the global agri-food industry. We propose a framework that maps six benefits of AI-based systems to three benefits of the agri-food supply chain and end with a call to action for a concerted effort between industry and academia to design, develop, and deploy AI solutions to make the world a better place.

In our third piece, Oteng Ntsweng, Wallace Chipidza, and Keith Barrett Carter pose a thought-provoking question: how can organizations harmonize humanistic and financial values using generative AI (GenAI) analytics? The article includes an examination of three real-world cases (PwC, Morgan Stanley, and Ørsted), exploring how GenAI is changing the analytics value chain, how data experts are preparing for the future, and what is being done to re-skill employees to enable effective collaboration between GenAI and employees. Building on insights from these cases, the authors provide frank conversations on ethical digital transformation and AI for social good. Their recommendations include alignment between GenAI tools and need, adopting an employee-inclusive GenAI adoption approach, and promoting leadership teams that are knowledgeable in AI and analytics. The authors conclude that the incorporation of GenAI in business analytics offers the potential for significant advancements in business value, but there is a need to foster collaboration between GenAI and data experts to enhance value without losing humanistic outcomes.

In our final article, Maria P. Diaz Campo, Arman Ghafoori, and Manjul Gupta explain the growing trend of AI hallucinations (when GenAI generates unreasonable or inaccurate output) and how it can have detrimental consequences for organizations and individuals. The authors suggest that the degree to which such hallucinations are tolerated depends heavily on context and argue that individuals have lower tolerance levels for AI hallucination when the stakes are high (and vice versa when the stakes are low). They point out the importance of considering the contextual nuances surrounding the use of GenAI to help developers, decision makers, and academics establish best practices and manage potential sources of error. They also highlight the significance of understanding culture at the national level, as it can be instrumental in assessing societies’ tolerance levels to AI hallucinations. The authors‘ suggested model provides unique insight into levels of analysis (i.e., personality, organizational culture, national culture) and how they pertain to AI hallucination. They make a compelling case that understanding context is critical for making informed decisions about strategically adopting and implementing GenAI (and emerging technologies in general). The article concludes with several key takeaways that can help balance potential value opportunities and risk tolerance.

This issue of Amplify clearly shows how business analytics can create business and social value and should motivate business leaders to be hypervigilant about their data because, just like oil disasters, data disasters (e.g., data breaches, cyberattacks) have increased in frequency and impact. Management teams that actively nurture a strong analytics culture and focus on the innovative use of analytical tools while growing their investments in emerging technologies will be in a stronger position to future-proof their business and mitigate potential disasters.

References

1 “Business Analytics Market Report by Software (Query, Reporting and Analysis Tools, Advanced and Predictive Analytics, Location Intelligence, Content Analytics, Data Warehousing Platform, and Others), Deployment Type (Cloud-Based, On-Premises), End-User (Large Enterprises, Small and Medium Size Enterprises), Vertical (BFSI, Energy and Power, Manufacturing, Healthcare, Government, Education, Media and Entertainment, Telecom and IT, and Others), and Region 2024–2032.” International Market Analysis Research and Consulting (IMARC) Group, accessed May 2024.

2 Suarez-Davis, Jon. “Data Isn’t ‘The New Oil’ — It’s Way More Valuable Than That.” The Drum, 12 December 2022.

3 Hagiu, Andrei, and Julian Wright. “When Data Creates Competitive Advantage.” Harvard Business Review, January-February 2020.

4 Dennehy, Denis. “Ireland Post-Pandemic: Utilizing AI to Kick-Start Economic Recovery.” Amplify, Vol. 33, No. 11, 2020.